May 26, 2020: Richard Hunton, Quantum Data Analytics (QDA) CEO, shares his thoughts on the European Debt Purchase market and the impact that Covid-19 has had upon it.

What has been the immediate impact of the Pandemic?

Working with the range of clients QDA has across the world puts us in a unique position to assess the immediate impact on the NPL (Non-Performing Loans) market, already we have observed;

- A divergence between bid and ask prices

- A pausing of activity as both buyers and sellers assess their risk / rewards profiles and financing becomes more difficult

- As the perceived risk of NPL portfolios have increased investors are now presented with other opportunities for investment other than the NPL markets

- Investors are putting increased pressure on servicers to achieve desired IRR’s on already invested portfolios, additionally they are looking to revalue their current holdings

- In the short term the markets will become dominated by opportunistic investors looking to take advantage of the market turmoil

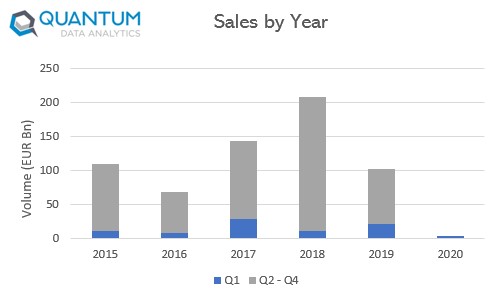

In total over the whole of Q1 2020, a quarter where Covid-19 impact was minimal, total volumes were seen to be very much lower than preceding years; the Q2 impact is set to be far larger.

How do you assess the likely impact of Covid-19 on 2020 recoveries?

We deal daily with a range of servicers that use QDA to enhance their collections or to minimise costs. They suggest that the reduction of cash flow in 2020 is likely to be large, no less than 30% is the consensus. Many market observers believe that this will just be a delay in timing rather than an absolute cash flow reduction, however our experience leads us to think that this assessment may be a little bullish.

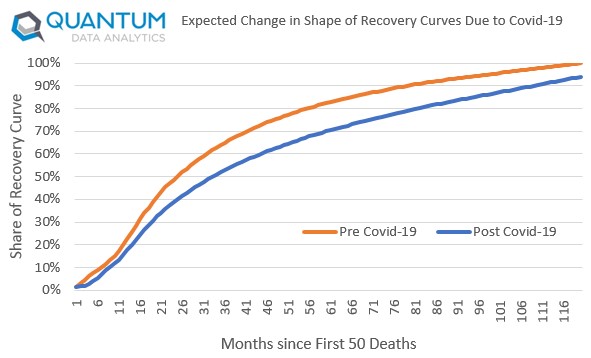

The shape of recovery curves will have to change due to customers capitalising on a new range of debt-friendly measures imposed by Governments. Additionally, an already strained litigation infrastructure prior to Covid-19 will lead to future delays in collection processes due to an increase of backlogs, such that servicers with the utmost insights into their customer databases will prove to have the greatest adaptability under such circumstances and beyond.

Furthermore, such unprecedented circumstances will bring sensitivity to all partakers of the NPL market as current knowledge of considering historic information in forecasts will become near obsolete. Processes during and post Covid-19 will pay greatest dividends to those who are likely to think outside the box, adapt and bring innovative approaches.

Earlier in the pandemic, Quantum undertook the task to assess the Covid-19 impact upon recovery curves by utilising Quantum’s data lake at a micro and macro level and visualising it by creating the curves below. Such type of intelligence will be key in both front book purchases and back book valuations and should result in a real competitive advantage, these curves varied greatly between both country and asset type.

How have differing markets been affected?

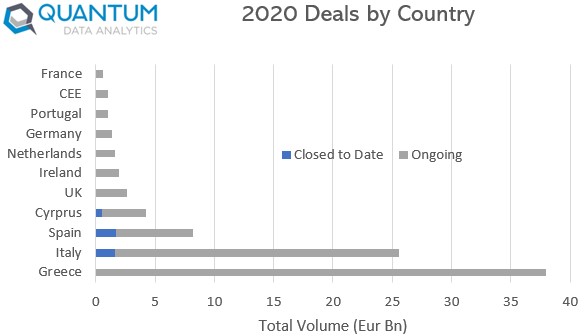

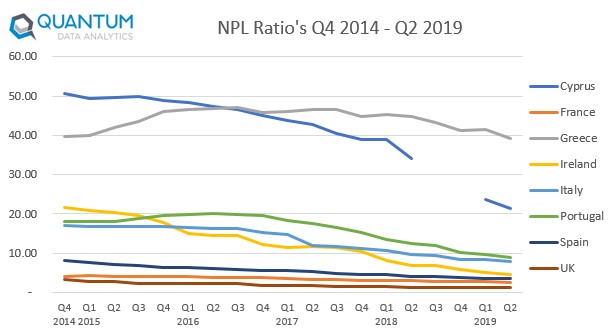

The Southern European markets have suffered a bigger impact than those elsewhere, for instance than the Nordics, we are already seeing investors moving from less mature markets such as Greece to the safer, more mature markets such as Spain where more outcome data can be used to mitigate their portfolio risk.

We also expect new markets to rapidly develop depending upon regulators, the volumes in both France and Germany could expand rapidly and the UK, if the ECB forecasts are anywhere new correct regarding unemployment and HPI, could in 12 to 24 months have the largest NPL stock in Europe

The secure market has and will be greatly affected but the impact will differ greatly between countries and asset classes, residential assets in urban areas will hold their values better than commercial assets based upon the hospitality sector for instance.

The total amount of activity pre Covid-19 in terms closed deals and pipeline clearly shows that the recent NPL hotspots are set to continue post pandemic.

What’s the good news?

QDA potentially sees the Covid-19 impact as being relatively short term, the key market attributes still exist which post Covid-19 should allow the NPL markets to bounce back quickly.

- There is an abundance of capital waiting to be deployed

- We would expect an increase in JV’s as buyers look to spread risk

- Secondary markets are set to grow as the supply of new NPL stock becomes smaller and some investors look to exit positions

- Deals that have been postpone or placed on hold to resumed by H2 2020

- We are currently working with some buyers that instead of looking to deploy capital are using our services to review and enhance their understanding of their back books, this current time presents a real opportunity to undertake this type of project

- Securisation vehicles being used in both Italy and Greece will increase the likelihood of sales

- NPL ratio’s across Europe has decreased but there is still much work to complete

What’s the future for NPL markets?

Technology such as A.I. is revolutionising other financial verticals by implementing new, accurate and efficient methodologies we are sure that technology will bring sizable changes to the NPL market.

We see high quality data collection and transparencies as being a major issue in the EU market that has caused a stall in new technology adoption. We believe emerging technologies have huge potential in taking the market forward, it can minimise if not nullify human errors in processes, reduce the time taken for valuations to be processed, providing more precise unrealised valuations and automated electronic litigation processes using law-tech.

Furthermore, QDA has already begun capitalising on emerging technologies such as AI and bigdata in providing end-to-end solutions to clients using the proprietary Quantum Valuation Process. We look forward in partnering with clients to enhance their data collection architecture and assisting in implementing new technologies to improve their end-to-end processes.

These changes may not be accepted by all players in the market, the complexity in understanding and implementing new technology will be a barrier for many, however those that do adapt quickly will thrive.

What do you see as the long-term Impact of Covid-19?

Once some semblance of market normality is restored there undoubtably will be some long-term impacts, one of the greatest areas will be regarding the due diligence process. Remote working has and will continue to be the norm and the ability to undertake a remote diligence process, and potentially the entire valuation process, will become a tangible competitive advantage. Investors will continue to look to mitigate risk, specifically they will look for partners that:

- Have specific track record in the assets being priced

- Have data related the asset class

- Have a technological edge in valuations

Fortunately, this is exactly the service that QDA supplies.

Other opportunities from Covid-19

Even if buyers choose to suspend activity during the pandemic we are seeing many undertaking other types of projects to ensure post Covid-19 they are in the strongest position possible, examples include;

- Data Management: For data to be valuable and applicable, data needs to be stored as one single point of truth, cleaning and optimising this data will reap benefits in the future.

- Analytics: Analytics should be the backbone of both strategy and operations. Analytical models can be created with a broad range of objectives; contactability, probability of payment, litigation enforcement scorecards are all models we have built recently.

- Investment in Staff: Hiring and developing staff is key, in March this year Quantum diversified its skillsets by hiring AI specialists. Their roles increase Quantum’s potential to expand into other domains, assist in implementing and venturing into new technologies to create robust processes. This hire will ensure we are well positioned for the explosion in AI we were seeing before Covid-19 and which will continue at pace post pandemic.

- Invest in Technology: Covid-19 has undoubtably changed the way we all interact with each other, we have seen those with good, robust, digital communication channels really benefit together with those whose platforms allowed seamless remote working. Technology has never been more key, QDA has experience and can aid potential partners in implementing such strategies.

To learn more regarding Quantum Data Analytics and the services that we can supply please visit www.quantumda.co.uk, email directly lauren@quantumda.co.uk or call +44 (0)207 632 7565.